uber eats tax calculator canada

1228538970 TQ0001 WILL I STILL BE ABLE TO COMPLETE UBER EATS DELIVERIES. Uber Eats Income.

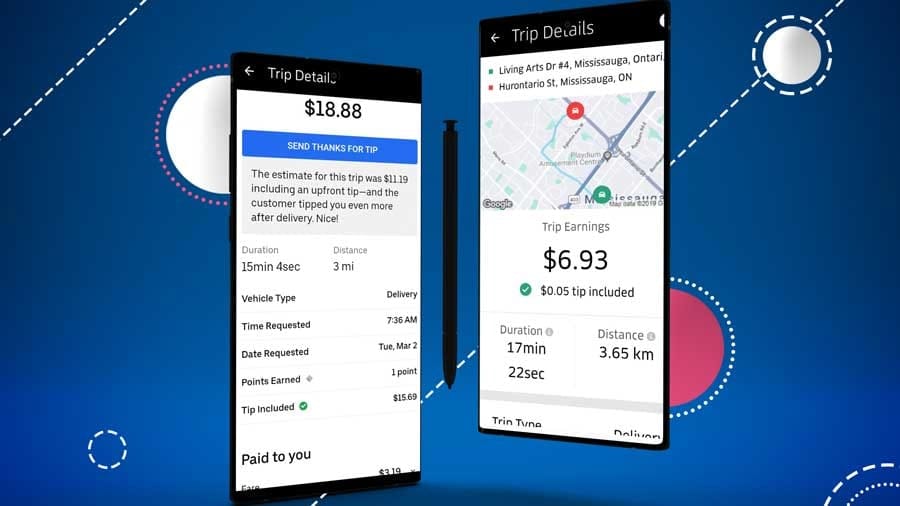

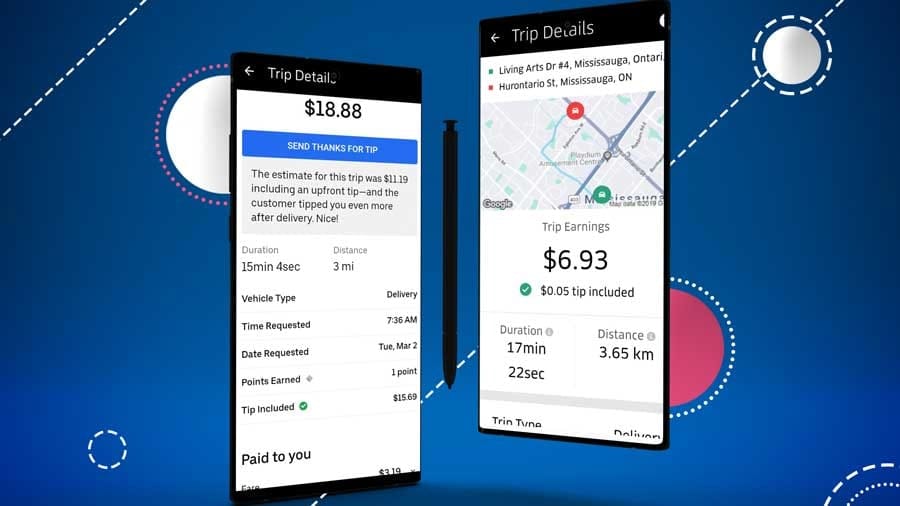

Do Uber Eats Drivers See Your Tip When You Order Food Online

Yes you will still be able to complete Uber Eats deliveries.

. Who the supply is made to to learn about who may not pay the GSTHST. Filter vie w s. To report self-employment income use the Find button to searchselect the option for Business.

Comes out to 35. If you are currently driving an Uber then this video will show you how to correctly report your income and expenses in your tax return. The average number of hours you drive per week.

Same pizza same toppings. Understanding your 1099 forms Doordash Uber Eats Grubhub. According to my Uber Tax Summary I earned 26300 driving with Uber Eats in 2019 but I didnt get a 1099-K.

Well send you a 1099-K if. I cant easily calculate my usage as I check my Uber apps daily but only work casually when I feel like it. 10000 work miles x 056 mileage rate 5600 deduction.

Instant 10 mark up on the pizza the extra tax the fee the tip. The city and state where you drive for work. Introducing the tax guide for Grubhub Uber Eats Doordash Instacart and other gig economy contractors.

With so many people looking to hail a ride the Big Apples Uber drivers have the potential to make up to 3035 an hour. The rate you will charge depends on different factors see. Using our Uber driver tax calculator is easy.

You may have heard that Uber drivers must register for GST but that tax law only applies to taxis who drive passengers not food. Add a slicer J Pr o tect sheets and ranges. Im pretty sure 4080 is not what I put for my income from UE.

Its very tough to write off something like a full car payment or lease though. WHAT ARE UBERS TAX REGISTRATION NUMBERS. C lear formatting Ctrl.

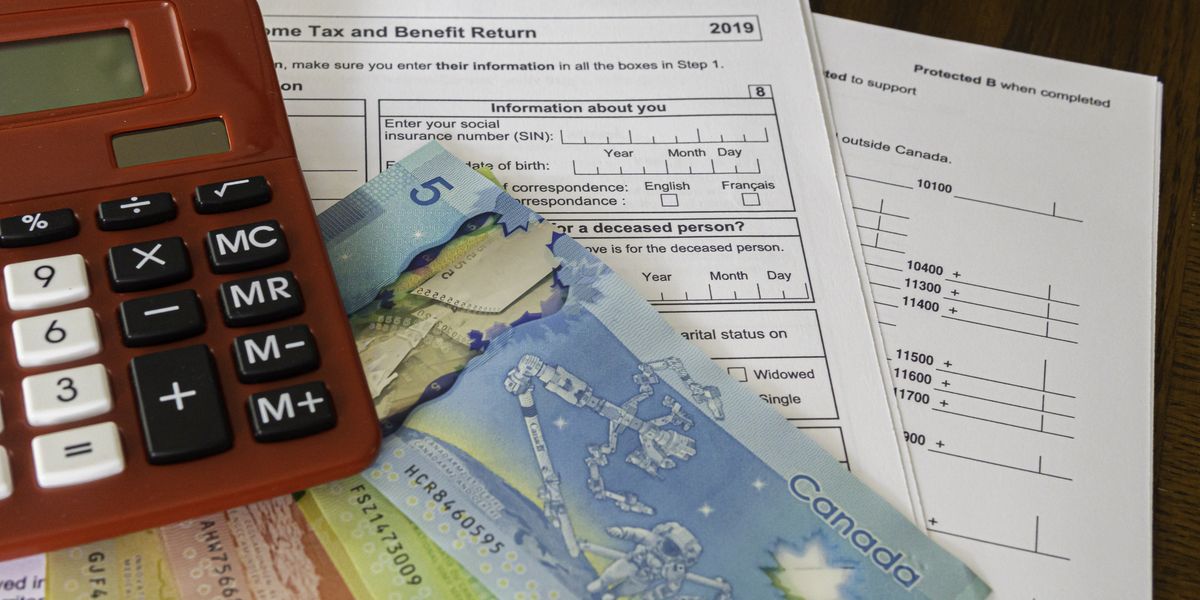

Uber drivers are considered self-employed in Canada otherwise known as an independent contractor. Certain states have implemented lower reporting thresholds. It should be the income on that list HST bottom of the list the referrals no HST from the top right of the sheet.

But I usually just throw them a 20 for the large and call it even. In accordance with the rules and regulations outlined by the Canada Revenue Agency CRA Uber drivers Uber Eats Lyft Skip the dishes or other ride-sharing drivers are self-employed and are required to file their Canadian income taxes as being self-employed. Create a f ilter.

If you enjoyed make. Therefore you might receive a 1099-K for amounts that are below 20000. The list of income on the Uber sheet is before HST.

If your annual income is over 37000 then the tax rate is 325 and you can get 675 1-325455625. The tax summary provides a. Large pizza with 2 toppings is 1599tax Sometimes theyll have a party size 1 topping for 1999.

Uber pays weekly which is great for you spreadsheet. View solution in. Your 1099-K is an official IRS tax document that includes a breakdown of your annual on-trip gross earnings.

The Canada Revenue Agency requires every ridesharing driver to create a GSTHST account number which must be shared with Uber within 30 days of a first trip. Learn more on irsgov. As a food delivery driver normal tax rules apply and you only need to register for GST if you earn more than.

For more information on how these changes may affect your work on the Uber Eats app check out the resource below. As such Uber drivers must keep records of the money they receive from Uber and all of their expenses so that they may prepare and file proper income tax returns each year. This is the easiest method and can result in a higher deduction.

Its 560 less in income taxes if youre in the 10 bracket. Standard IRS Mileage Deduction. Type of supply learn about what supplies are taxable or not.

Youll need to enter information such as the name address of your business use your own name address industry code 492210 and the self-employment income. Like any activity that produces income there are tax implications involved. So r t range.

If your total income before deducting expenses is less than 30000 you will be referred to as a small supplier and you are not required to register for a business number or GSTHST account. Phone is monthly 110 total. If you put 10000 miles on your car thats a 5600 expense deduction you can claim on your taxes for the 2021 tax year.

The articles in the 2021 Tax Guide for Gig Economy Contractors. It only takes a few minutes to register online and youll have your GSTHST number instantly. If you want to get extra fancy you can use advanced filters which will allow you to input.

The only official tax document I got from Uber was a 1099-Misc which states I earned only 4080 Nonemployee Compensation. Where the supply is made learn about the place of supply rules. A l ternating colors.

How is this handled. S ort sheet. The following table provides the GST and HST provincial rates since July 1 2010.

In 2021 this would look like. Increased demand for food delivery services has led to an increase in the number of food delivery drivers. Those guys in the shop never get tips and its bs.

If youre a food delivery driver you must have an ABN but you do not have to register for GST. The total income for the year should be listed on the tax summary. Uber Rasier Canada Inc.

That means that in addition to the usual income tax forms the Income Tax and Benefits Return you. Thats 857 less on your Self-employment tax bill. Independent contractor taxes 101.

Do I just divide by 4 to get weekly. To use this method multiply your total business miles by the IRS Standard Mileage Rate for business. Once the income passes the 30000 the driver has to register for a GSTHST QST in Quebec account even for zero-rated.

When you report Gross income including GST. Follow the step-by-step instructions to register. In other words it reduces your taxable Uber income by that much.

What your real income is for gig economy contractors. Recent research shows that Australians spend over 26 billion each year on food and drink delivery through companies such as Menulog UberEats and Deliveroo. Because Uber drivers are independent contractors they will not be issued.

GSTHST on Food Delivery. Your average number of rides per hour. All you need is the following information.

Keep in mind that this HST was not calculated on the Tips that are included on the top list not it should be. What you are taxed on. Uber also issues quarterly statements which dont line up with the above.

Ubereats Vancouver Driver Pay And Sign Up Requirements

Do Uber Eats Drivers See Your Tip When You Order Food Online

Uber Tax Summary Information For Driver Partners Uber Uber Blog

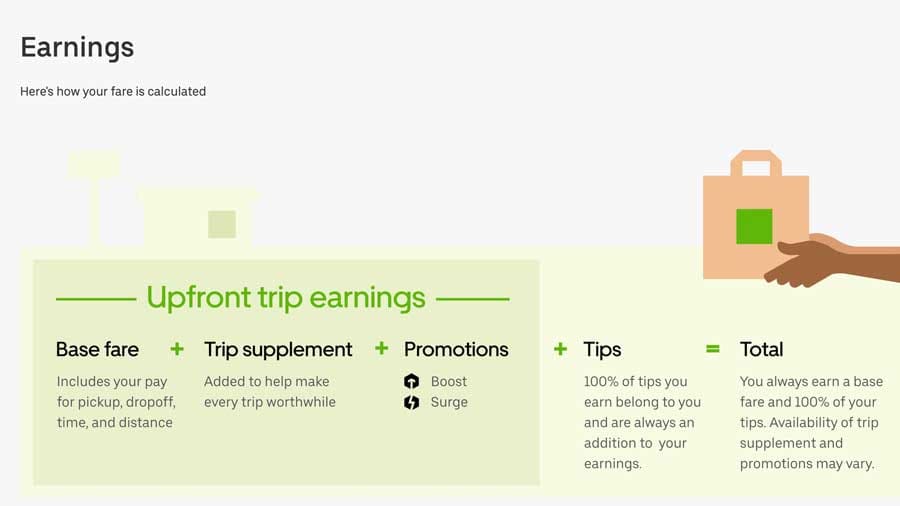

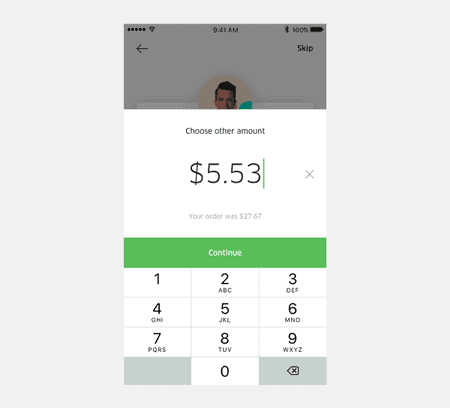

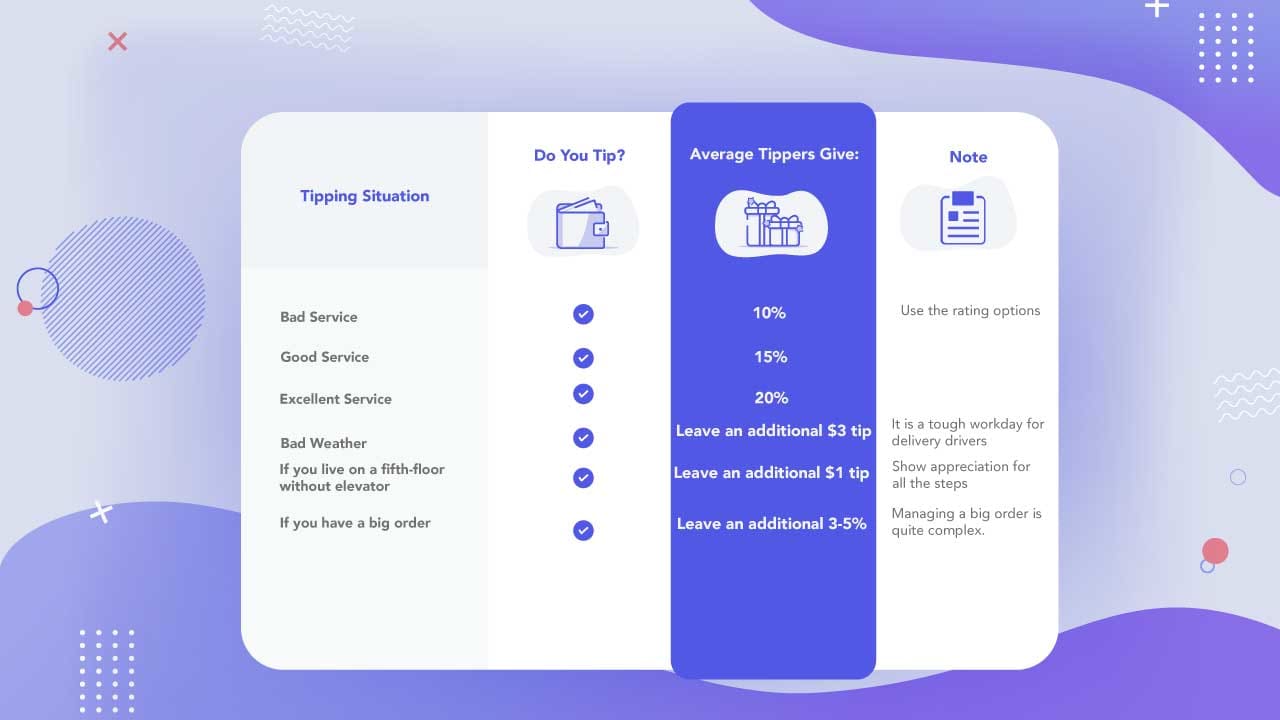

Tip Uber Eats Should You Tip Your Driver Ridester Com

Ubereats Vancouver Driver Pay And Sign Up Requirements

Tax Help Canada 8 Things The Cra Wants You To Remember This Year Narcity

Tip Uber Eats Should You Tip Your Driver Ridester Com

Do Uber Eats Drivers See Your Tip When You Order Food Online

Uber Drivers Gross Income Vs Net Income Turbotax Tax Tip Video Youtube

How To Use Tax Function On Calculator Youtube

Uber Tax All Uber Drivers Should Read Our Tax Guide Asap

Uber And Lyft Driver Earning Average Of 2000 Week Tips Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

People S Choice Credit Union Offset Account Review Information Finder Com Au

Quick Tips Turbotax Workshop For Uber Partners Youtube

Uber Tax All Uber Drivers Should Read Our Tax Guide Asap

Uber Driver Requirements Toronto Pay Rates And Cars

Ubereats Vancouver Driver Pay And Sign Up Requirements

Uber Drivers Gross Income Vs Net Income Turbotax Tax Tip Video Youtube